Just How Offshore Finance Centres Enhance Wealth Monitoring Techniques

Just How Offshore Finance Centres Enhance Wealth Monitoring Techniques

Blog Article

The Effect of Offshore Financing Centres on International Business Workflow and Compliance

Offshore Money Centres (OFCs) have actually come to be pivotal fit international service procedures, supplying unique advantages such as tax obligation optimization and regulative versatility. Nevertheless, the increasing worldwide focus on compliance and openness has actually presented a complicated array of difficulties for businesses seeking to leverage these centres. As firms browse this twin fact of chance and analysis, the ramifications for strategic preparation and operational integrity become progressively noticable. Comprehending exactly how to stabilize these aspects is important, yet lots of organizations are left questioning just how best to adapt to this evolving landscape. What approaches will emerge as one of the most reliable?

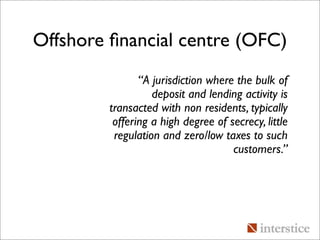

Recognizing Offshore Finance Centres

Offshore money centres (OFCs) offer as critical hubs in the worldwide monetary landscape, helping with international service deals and financial investment opportunities. These jurisdictions, often identified by desirable regulative environments, tax obligation rewards, and privacy laws, draw in a diverse variety of economic solutions, including financial investment, banking, and insurance policy administration. OFCs make it possible for services to maximize their economic operations, manage threat much more successfully, and achieve better flexibility in their financial strategies.

Normally located in areas with reduced or no tax, such as the Caribbean, the Network Islands, and specific Oriental territories, OFCs give a legal structure that enables business to run with family member ease. They typically have robust economic infrastructures and a solid focus on privacy, which interest international companies and high-net-worth people looking for to secure their possessions and get to international markets.

The operational structures of OFCs can vary dramatically, influenced by local policies and international compliance standards. Understanding the distinct functions of these centres is vital for organizations seeking to browse the intricacies of international money (offshore finance centres). As the global financial landscape evolves, OFCs remain to play a considerable function fit the strategies of services operating throughout borders

Advantages of Making Use Of OFCs

Using offshore finance centres (OFCs) can substantially enhance a business's financial performance, particularly when it involves tax obligation optimization and governing versatility. One of the key advantages of OFCs is their ability to offer positive tax obligation routines, which can bring about significant savings on company tax obligations, resources gains, and inheritance taxes. By tactically alloting profits to jurisdictions with reduced tax rates, business can improve their general monetary performance.

Additionally, OFCs usually existing streamlined regulatory settings. This reduced administrative burden can promote quicker decision-making and more dexterous service operations, permitting firms to react swiftly to market modifications. The regulatory structures in lots of OFCs are created to draw in international investment, offering businesses with a conducive atmosphere for growth and growth.

Furthermore, OFCs can offer as a critical base for international operations, making it possible for firms to access global markets extra successfully. Improved privacy actions likewise safeguard sensitive financial details, which can be essential for preserving competitive benefits. Overall, the usage of OFCs can develop a more efficient financial framework, supporting both operational performance and strategic organization goals in a worldwide context.

Challenges in Conformity

Another major difficulty is the evolving nature of worldwide guidelines intended at combating tax evasion and money laundering. As governments tighten up analysis and increase reporting requirements, services must continue to be dexterous and notified to avoid charges. This necessitates ongoing financial investment in compliance resources and training, which can strain operational spending plans, particularly for smaller sized business.

In addition, the assumption of OFCs can produce reputational dangers. Companies running in these territories might face uncertainty concerning their objectives, leading to possible issues in stakeholder relations. This can negatively affect client trust and capitalist self-confidence, additional making complex compliance efforts. Eventually, businesses need to very carefully navigate these obstacles to guarantee both conformity and sustainability in their worldwide procedures.

Regulatory Trends Influencing OFCs

Recent governing fads are considerably reshaping the landscape of overseas money centres (OFCs), engaging organizations to adapt to an increasingly stringent conformity atmosphere. Federal governments and global companies are carrying out robust actions to boost openness and combat tax evasion. This change has caused the adoption of campaigns such as the Common Coverage Requirement (CRS) and the Read More Here Foreign Account Tax Obligation Conformity Act (FATCA), which need OFCs to report economic information about foreign account owners to their home jurisdictions.

As compliance prices climb and regulatory analysis escalates, companies using OFCs have to browse these modifications very carefully. Failure to adapt could cause severe penalties and reputational damage, emphasizing the importance of positive compliance methods in the developing landscape of overseas financing.

Future of Offshore Financing Centres

The future of offshore finance centres (OFCs) is positioned for considerable transformation as advancing regulatory landscapes and moving international economic dynamics improve their role in worldwide organization. Raising stress for openness and conformity will challenge conventional OFC models, triggering a change in the direction of better liability and adherence to global criteria.

The fostering of electronic modern technologies, including blockchain and expert system, is anticipated to redefine how OFCs operate. These innovations may enhance operational effectiveness and boost conformity devices, allowing OFCs to provide more safe and clear services. Additionally, as international capitalists seek jurisdictions that prioritize sustainability and company social responsibility, OFCs will certainly need to adapt Web Site by accepting lasting finance concepts.

In feedback to these fads, some OFCs are expanding their solution offerings, relocating beyond tax obligation optimization to consist of wealth management, fintech solutions, and advisory solutions that align with global ideal methods. As OFCs advance, they should balance the requirement for competitive advantages with the requirement to comply with tightening up policies. This double focus will ultimately establish their sustainability and importance in the worldwide service landscape, guaranteeing they continue to be essential to worldwide monetary procedures while also being responsible business citizens.

Verdict

The impact of Offshore Money Centres on global service procedures is extensive, supplying various advantages such as tax obligation performances and structured procedures. Nevertheless, the increasing intricacy of compliance requirements and enhanced regulative examination existing substantial obstacles. As global standards evolve, the functional landscape for businesses utilizing OFCs is transforming, demanding a critical strategy to guarantee adherence. The future of Offshore Money Centres will likely depend upon stabilizing their fundamental benefits with the demands for better openness and responsibility.

Offshore Financing Centres (OFCs) have actually become crucial in forming international business procedures, offering distinct benefits such as tax obligation optimization and governing adaptability.Offshore money centres (OFCs) serve as pivotal centers in the worldwide economic landscape, promoting worldwide company transactions and financial investment chances. In general, the use of OFCs can create an extra efficient economic framework, supporting both operational effectiveness and tactical organization goals in a global context.

Navigating the intricacies of compliance in offshore financing centres (OFCs) offers significant challenges for organizations.Current governing patterns are considerably reshaping the landscape of overseas finance centres (OFCs), compelling companies to adapt to a significantly rigorous compliance environment.

Report this page